GST is all about bringing a smooth flow of funds and compliances for ease of doing business in India. To facilitate such a steady stream, the Government must provide for a hassle-free refund processing system. The prevailing tax structure is cumbersome, and it takes months and seldom years to get refunds from the Government.

GST provides for an efficient and dynamic invoice based tracking system, validating every transaction, ensuring systematic checking of the same. It comes out to be a massive relief for the manufacturers and exporters, especially those in a 100% Export Oriented Units or Special Economic Zones, whose working capital gets blocked in dealing with the time-consuming process of refunds.

GST refund services at SAAAR

SAAAR Wealth Advisors is the best GST refund consultant in Delhi that can assist you in following:

- Filing application of refunds

- Preparation of complete documentation for refund process

- Preparation of declaration of non-passing of incidence of tax to any other person

- All required certifications by a Chartered Accountant

- Representation before the department on behalf of clients

- Regular follow-ups with the department for getting refunds at the earliest

- Any consultancy related to refunds

If you are a registered person and want to claim GST tax refund in Delhi, SAAAR can be helpful in providing best GST refund services in Delhi. You can reach us at info@saaar.co.in for any issues related to GST refunds.

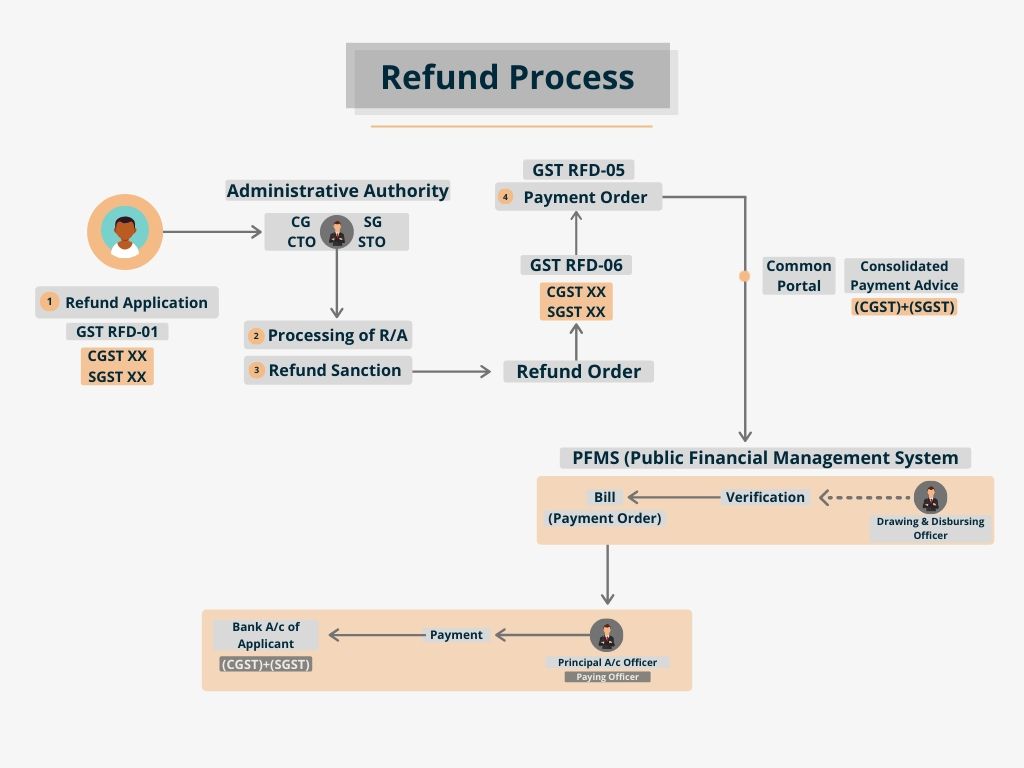

Diagrammatical presentation refund process

There are certain situations where the refund arises. Let us check out these in details.

Refund of Input Tax Credit

1. Export of goods or services under LUT/Bond, without the payment of GST

2. Supply of goods or services to SEZ units and developers under LUT/Bond, without the payment of GST

3. Refund of accumulated credit of input tax due to inverted duty structure, i.e. when input tax rate is higher than output tax

Refund of IGST on Zero-Rated Supply

4. Export of goods or services on payment of GST

5. Supply of goods or services to SEZ units and developers on payment of GST

Refund under ‘deemed export scheme.

6. Deemed Exports (refund available to both supplier and recipient)

Refund to UIN Holders

7. Refund of input taxes on purchase made by UN Agencies, embassies etc.

8. Refund to CSD canteens

Refund to International Tourists

9. Refunds to International tourists of tax paid on goods procured in India and brought abroad at the time of exit from India

Other Refunds

10. Refund arising of any judgement, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court

11. Refunds when a provisional assessment is finalised

12. Excess balance in electronic cash ledger

13. Excess payment of tax due to an error or mistake

14. Refund of IGST paid by treating the supply as inter-state supply which subsequently comes out to be intra-state supply and vice versa

15. Refund for the issue of refund vouchers for taxes paid on advances where the actual supply of goods or services does not take place

The list provided above is only indicative and not exhaustive.

The GST department does not provide the refunds until unless the taxpayers claim it. There exists a systematic procedure for the same. The taxpayers are required to file an application and follow the correct procedure for getting the refund to their bank accounts.

What is the time limit for making a refund application?

The taxpayers are required to make an application within two years from the relevant date as given in the Explanation to section 54 of the CGST Act,2017. Let us understand the significance of the “relevant date” as these dates are different in different situations as discussed below:

| S.No | Situations | Relevant Date |

| (a) | In the case of goods exported out of India where a refund of tax paid is available in respect of goods themselves or, as the case may be, the inputs or input services used in such goods,- | |

| (i) | If the goods are exported by sea or air | Date on which vessel or aircraft in which goods are loaded, leaves India |

| (ii) | If goods are exported through land route | Date on which such goods pass the frontier |

| (iii) | If goods are exported by post | Date of dispatch of goods by the post office concerned |

| (b) | In the case of supply of goods regarded as deemed exports where a refund of tax paid is available in respect of the goods | The date on which return related to such deemed exports is filed |

| (c) | In case of services exported out of India where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services, | |

| (i) | Where the supply of services had been completed prior to the receipt of payment against such supply | Date of payment in convertible foreign exchange or in INR wherever permitted by RBI |

| (ii) | Where payment for the services had been received in advance prior to the date of issue of invoice | Date of issue of invoice |

| (d) | In case where the tax becomes refundable as a consequence of judgement, decree, order or direction of the Appellate Authority, Appellate Tribunal or any Court | Date of communication of order |

| (e) | In case of refund of unutilized ITC arising due to ‘inverted tax structure’ | Due date of furnishing of return under section 39 for the period in which such claim for refund arises |

| (f) | In case where tax is paid provisionally under this Act or the rules made thereunder | The date of adjustment of tax after the final assessment thereof |

| (g) | In the case of a person, other than the supplier | The date of receipt of goods or services by such person |

| (h) | In any other case | The date of payment of tax |

It is necessary to keep in mind these relevant dates because any negligence in filing refund applications within prescribed time limits could lead to undesired blockage of funds.

What is the process of refund under GST?

1. Every taxpayer needs to file a claim of refund in Form GST RFD-01. Once a form is submitted, an acknowledgement gets generated in Form GST RFD-02 for future references and sent to the applicant through email and SMS.

2. In case the system finds some deficiencies in the refund application, then the same has to be pointed out within 15 days. The proper officer will issue a Form GST RFD-03(deficiency memo) to the applicant pointing out the issues through common portal electronically requiring him to file a fresh refund application after rectification of such deficiencies.

3. The proper officer, after examination of the claim and the proof submitted in support thereof and on being satisfied that the amount claimed as refund is due to the applicant, shall make a provisional refund order in Form GST RFD-04, sanctioning the amount of refund due to the said applicant provisionally within 7 days from the date of the acknowledgement.

4. The proper officer shall issue a payment advice in Form GST RFD-05 for the amount sanctioned, and the same shall be electronically credited to any of the bank accounts of the applicant mentioned in his registration particulars and as specified in the application for refund.

5. The proper officer sanctions the claim of refund in Form GST RFD-06 if he finds the request in order. The refund has to be sanctioned within 60 days from the date of receipt of application complete in all aspects. If it is not approved within the time, the interest @ 6% p.a. (as notified presently) will have to be paid under section 56 of the CGST Act,2017.

Can refund be rejected?

When the proper officer is satisfied that the claim is not appropriate or is not payable to the applicant, he shall issue a notice in Form GST RFD-08 to the applicant requiring him to furnish a reply in Form GST RFD-09 within 15 days of the receipt of such notice. After consideration of the applicant’s response, the office can accept or reject the refund claim and pass an order accordingly.

Is there any minimum threshold for a refund?

No refund shall be payable to an applicant if the amount of refund is less than Rs. 1000. This limit shall be applicable each tax head wise (not cumulative tax).

It is to be noted that this limit would not apply in cases of refund of excess balance in e-cash ledger.

| Applicant | Refund claimed | Admissibility |

| Mr. A | CGST: Rs 900 + SGST Rs 900 | Refund inadmissible – as limit shall be applied for each tax head separately and not cumulatively |

| Mr. B | IGST: Rs 1200 | Refund admissible fully |

What is the proof required for non-passing of incidence of tax to any other person to claim a refund?

Following documents evidence required on the passing of incidence of tax

(i) If the refund claim is less than Rs. 2 Lakhs

A self-declaration by the applicant to the effect that the incidence of tax has not been passed to any other person will suffice to process the refund claim.

(ii) For refund claims of Rs. 2 Lakhs and more

A certificate from a Chartered Accountant/Cost Accountant will have to be given.

However, the declaration above/certificate is not required to be furnished in the following cases:

(a) refund of tax paid

– on the export of goods and services or

– on inputs or input services used in making such exports

(b) refund of unutilised ITC as per Sec 54(3);

(c) refund of tax paid on a supply which is not provided, either wholly or partially, and for which invoice has not been issued, or where a refund voucher has been issued

(d) refund of tax paid on a transaction treating it to be an intra-state supply, but which is subsequently held to be an inter-state supply or vice-versa

(e) the tax or interest borne by a notified class of applicants

The process is extensive in itself and once followed adequately, availing refund can become very smooth and hassle-free. It will transform the face of the long-drawn refund process and provide a boost to the manufacturing or export industry. Those refunds, which usually took years to pass, can now be made in just 60 days. The reliable IT system of the GSTN has actively facilitated this action into the picture.

Frequently Asked Questions

- Can a refund be claimed even if GSTR-1 or GSTR-3B for a particular period has not been filed?

No. A refund claim for a tax period can be filed only after filing the details in GSTR-1 for the said tax period. It is also to be ensured that GSTR-3B has been filed for the tax period immediately preceding the month in which the refund application is being filed.

- In which situations refund of accumulated ITC is allowed under GST?

Refund of accumulated ITC is allowed only when the credit accumulation is on account of zero-rated supply or on account of the inverted duty structure.

- Is there any time limit within which refund of excess balance in cash ledger can be claimed?

No. Refunds of excess balance in cash ledger can be claimed anytime.

- Will the refund be denied on account of exports made without submitting LUT?

No. The benefits of zero-rating will not be denied where it has been proved that exports have been made as per the relevant provisions. The delay in filing of LUT in such cases may be condoned, and the facility for export under LUT will be allowed retrospectively, taking into account the facts and circumstances of each case.

- Can refund claims of taxes paid under earlier laws (Central Excise/Service Tax) be made under GST?

No. Refund claims of taxes paid under earlier laws have to be dealt with as per the provisions of earlier laws only.